Easiest Way to Get USA International Student Loan: Find out Today!

The journey to pursuing higher education in the United States is a dream shared by countless international students around the globe. However, the cost associated with this endeavor often presents a formidable obstacle. This is where the significance of obtaining a USA international student loan comes into play, providing the financial support needed to turn this dream into a reality.

Navigating the intricate landscape of U.S. student loans for international students can be a daunting task, riddled with complexities and uncertainties. It's not merely about securing funds; it's about finding the easiest and most efficient way to do so. The right approach can make all the difference in ensuring that your academic aspirations are met without unnecessary financial stress.

In this article, we are dedicated to shedding light on the path toward securing a USA international student loan with ease. We understand the gravity of this decision and the pivotal role it plays in your academic journey. Our mission is clear: to equip you with actionable steps, valuable insights, and essential information that will guide you in finding the easiest way to obtain a USA international student loan. Whether you are seeking financial aid, exploring repayment options, or wondering about interest rates, we have you covered. Let's embark on this journey together, uncovering the best strategies and resources to make your educational dreams a reality.

USA International Student Loan: Basic Information

A USA international student loan is a financial tool designed to assist international students pursuing higher education in the United States. This type of loan helps bridge the gap between educational expenses and available funds, allowing international students to achieve their academic goals without the immediate burden of covering all costs upfront.

Key Points:

- Purpose: International student loans are specifically crafted to support non-US citizens studying at US institutions. These loans cover various expenses related to education, including tuition, living costs, textbooks, supplies, and even personal expenses.

- Eligibility: International student loan eligibility in the USA typically depends on several factors. Eligibility criteria for these loans may vary among lenders, but typically, students need to be enrolled or accepted into an accredited US educational program. Some lenders may require a US-based cosigner, while others offer loans without this requirement.

- Loan Amounts: The loan amount you can borrow depends on factors like the cost of attendance, your program of study, and the lender's policies. Loan limits can vary significantly, ensuring that students can access funds tailored to their specific educational needs.

- Interest Rates: International student loan interest rates can be fixed or variable. Fixed rates remain consistent throughout the loan term, while variable rates may fluctuate based on market conditions. It's essential to understand the implications of each option on your repayment plan.

- Repayment Terms: Repayment terms vary and can include grace periods, which allow you some time after graduation before repayment begins. Loan terms may also offer flexibility in repayment duration, ranging from several years to decades.

- Cosigner Requirement: While some lenders require a US-based cosigner to secure the loan, others offer loans without this requirement. A cosigner is typically a US citizen or permanent resident who acts as a guarantor for the loan, increasing the chances of loan approval and potentially securing better interest rates.

- Application Process: Applying for a USA international student loan involves submitting an application, providing documentation of your enrollment or acceptance, and potentially demonstrating your ability to repay. The application process may vary by lender, so be sure to follow their specific instructions.

- Benefits: International student loans provide financial support to cover educational costs that might otherwise be challenging to afford. They enable students to focus on their studies and immerse themselves fully in their academic pursuits.

USA international student loan is a valuable resource that allows international students to pursue education in the United States with financial assistance. While loan terms, eligibility requirements, and repayment conditions may differ among lenders, these loans play a crucial role in making higher education accessible to students from around the world.

Understanding the Landscape: USA International Student Loans

Studying in the United States is a dream for many international students seeking the true meaning of wealth, which encompasses top-notch education and diverse cultural experiences. While the prospect is exciting, the financial aspects can be a significant concern. However, the good news is that securing a student loan as an international student is indeed feasible, with many financial institutions offering tailored solutions.

These loans are designed to address the unique needs of international students and can cover various expenses:

- Tuition and Fees: One of the most significant expenses for any student is tuition. International student loans can cover tuition costs, enabling you to focus on your studies without constant financial worry.

- Living Expenses: Living abroad comes with its own set of expenses, including accommodation, food, transportation, and more. Student loans can help alleviate these financial burdens.

- Textbooks and Supplies: Course materials can be costly, especially for specialized programs. These loans can cover the costs of textbooks, supplies, and other academic necessities.

- Medical Insurance: Many universities require international students to have health insurance. Student loans can assist in covering these expenses

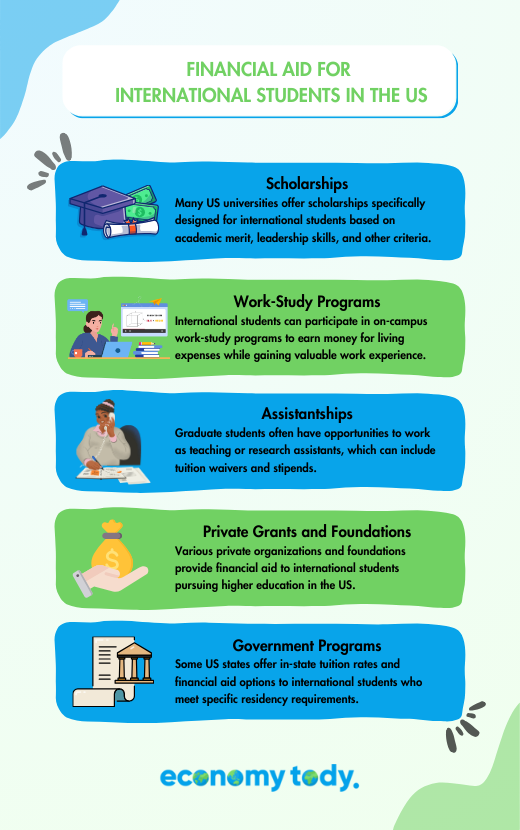

How to Pay for College as an International Student in the US

Navigating the financial landscape of studying in the US requires strategic planning. In addition to student loans and student financial aid, consider these approaches to manage your expenses:

- Part-Time Jobs: Many universities offer part-time job opportunities on campus. These jobs can provide extra income and valuable work experience.

- Internships: Internships not only enhance your skills but also offer financial compensation. They can be a practical way to earn money while gaining real-world experience.

- Work-Study Programs: These programs combine part-time work with your studies, allowing you to earn money while still prioritizing your academics.

International Student Loans with No Cosigner

For many international students, the requirement of a cosigner can be a significant hurdle when applying for loans. When it comes to securing international student loans with no cosigner, there are several key points to keep in mind.

- Personal Loan Options: Finding a personal loan designed specifically for international students can be challenging, but it's not impossible. Some lenders offer personal loans tailored to the needs of international students.

- Limited Availability: International student loans without a cosigner are relatively rare because lenders often require a cosigner to minimize their risk. However, some financial institutions and private lenders do provide such loans to eligible candidates.

- Eligibility Criteria: To qualify for these loans, you may need to meet specific eligibility criteria. These can include having a valid student visa, being enrolled in an eligible academic institution, and demonstrating the ability to repay the loan.

- Interest Rates: Be prepared for higher interest rates on loans without a cosigner, as lenders consider these loans riskier. Compare interest rates from different lenders to find the most affordable option.

- Loan Limits: International student loans often have limits on the amount you can borrow. These limits may vary depending on your program of study, school, and other factors.

- Credit History: Some lenders may require you to have a good credit history in the host country to qualify for a loan without a cosigner. Others may not consider credit history as heavily.

- Alternative Funding Sources: Explore other sources of financial aid, such as scholarships, grants, and part-time work opportunities, before turning to personal loans, as these options don't require repayment.

- Private Lenders: Private lenders, such as banks or online lending platforms, might offer international student loans without cosigners. Research and compare options to find the best terms and conditions.

- Repayment Terms: Understand the repayment terms of the loan, including the grace period after graduation and the length of the repayment period.

- Loan Application Process: Follow the lender's application process carefully. Prepare the necessary documentation, including proof of enrollment, visa status, and financial statements.

- Financial Planning: Before taking out a personal loan, create a detailed financial plan. Calculate your estimated expenses, including tuition, living costs, and loan repayment, to ensure you can manage your finances effectively.

- Seek Guidance: Consult your school's financial aid office or an international student advisor for guidance on loan options and financial planning.

Best International Student Loans for US Citizens

Even US citizens studying abroad or international students studying in the US might require additional financial assistance beyond scholarships and grants. Researching and comparing the best international student loans available is crucial:

- Interest Rates: Look for loans with competitive interest rates to minimize long-term costs.

- Repayment Terms: Consider loans that offer flexible repayment terms, including grace periods and deferment options.

- Loan Limits: Ensure that the loan limits are sufficient to cover your educational expenses, including tuition, living costs, and more.

International Student Loan for Master's Degree in the US

Pursuing a master's degree in the United States is an exciting step towards specialization and career advancement. The diversity of academic disciplines, renowned faculty, and research opportunities make it an attractive destination for international students. However, the financial aspect can be a significant concern. Securing an international student loan for a master's degree in the US is a feasible option to overcome these financial challenges.

Many financial institutions and private lenders offer loans specifically tailored to master's level education, promoting economic stability. These loans often cover tuition fees, living expenses, textbooks, and other related costs. Some key points to consider include:

- Loan Options: Research various lenders that specialize in international student loans for master's degrees. Explore interest rates, repayment terms, and loan limits to find the best fit for your needs.

- Cosigner Requirements: Depending on the lender, you might need a cosigner to qualify for the loan. Some lenders, however, offer loans without requiring a cosigner, making the application process easier for those without a US-based guarantor.

- Eligibility Criteria: Each lender has specific eligibility criteria. Typically, you'll need to be enrolled or accepted into an accredited master's program in the US. Some lenders may have GPA requirements as well.

- Loan Repayment Plans: Understand the repayment plans offered by lenders. Some loans might offer deferred repayment until after graduation, while others may require you to start making payments immediately.

- Interest Rates: Compare the interest rates offered by different lenders. Fixed or variable rates are common, and choosing the right option depends on your financial strategy

International Student Loan for Medical School in the US

Becoming a doctor is a noble and rewarding career path, but the journey through medical school can be financially demanding. International students aspiring to study medicine in the US can find tailored loans that support their medical education journey. Some considerations include:

- Medical-Specific Loans: Look for lenders that offer loans specifically designed for medical students. These loans often take into account the extended duration of medical education and offer flexible repayment options.

- Loan Limits: Given the high costs associated with medical education, these loans may have higher limits to cover tuition, living expenses, and additional medical equipment costs.

- Residency and Fellowship Considerations: Some medical loan providers might offer grace periods during residency or fellowship, recognizing that early medical professionals may have limited income during these periods.

- Loan Forgiveness Programs: Research if there are any loan forgiveness programs available to medical graduates who choose to work in underserved or rural areas.

International Student Loan for PhD in the US

Pursuing a PhD requires dedication, time, and often substantial funding. International students pursuing a PhD in the US can explore various options to secure financial assistance:

- Research Funding: PhD programs often provide research assistantships, teaching assistantships, and scholarships. These sources of funding can significantly reduce the need for loans.

- Fellowships and Grants: Investigate fellowships and grants specific to your field of study. Many institutions and organizations offer financial support to doctoral students.

- Departmental Funding: Some academic departments within universities have funds available for doctoral students. These funds might cover tuition, living expenses, and research costs.

- Private Lenders: Similar to master's degree loans, private lenders also offer loans tailored to doctoral students. Consider factors like interest rates, cosigner requirements, and repayment plans.

International Student Loan for Law School in the US

Legal education is intellectually enriching, but the costs associated with law school can be substantial. International students interested in pursuing a law degree in the US can explore loan options to support their education:

- Specialized Law School Loans: Some lenders offer loans specifically designed for law school students. These loans may offer unique benefits tailored to the legal education path.

- Bar Exam Financing: Some loans might cover expenses related to the bar exam, an important step for practicing law in the US.

- Loan Repayment Assistance Programs (LRAPs): Certain law schools have LRAPs that provide financial assistance to graduates pursuing public interest or lower-paying legal careers. These programs may help alleviate post-graduation financial stress.

- Loan Comparison: Research and compare loan terms from different lenders. Evaluate aspects such as interest rates, repayment flexibility, and grace periods.

Conclusion

In conclusion, securing a USA international student loan doesn't have to be a daunting task. With the information and resources available today, you can take control of your education and fulfill your dreams of studying in the United States. By exploring the various options and lenders, understanding the requirements, and making informed decisions, you can find the best lenders and the easiest way to obtain a USA international student loan that suits your needs.

So, don't delay any further. Take the first step towards your educational journey in the USA by researching and finding the right USA international student loan for you today. Your future awaits, and with the right financial support, you can make your academic aspirations a reality. Start your search now and open the door to a world of opportunities. Don't miss out – find your USA international student loan today and begin your educational adventure in the United States!

FAQ - International Student Loans for Various Fields of Study in the US

Q1: What is an international student loan for business school in the US?

A1: An international student loan for business school in the US is a financial resource designed to assist international students pursuing business degrees. These loans cover expenses like tuition, living costs, and other associated fees, helping students overcome financial barriers and focus on their education.

Q2: How does an international student loan for engineering school in the US work?

A2: An international student loan for engineering school supports international students studying engineering in the US. These loans provide funding for tuition, living expenses, and other educational costs, ensuring that students can fully engage in their technical education without worrying about finances.

Q3: Can I get an international student loan for computer science school in the US?

A3: Absolutely. An international student loan for computer science school is tailored for students pursuing computer science education in the US. These loans cover expenses such as tuition, materials, and living costs, enabling students to focus on their studies and projects without financial constraints.

Q4: How does an international student loan for nursing school in the US help me?

A4: An international student loan for nursing school assists international students pursuing nursing degrees in the US. These loans cover tuition, clinical expenses, and other essentials, ensuring that aspiring nurses can concentrate on their studies and clinical training without financial worries.

Q5: What is an international student loan for pharmacy school in the US?

A5: An international student loan for pharmacy school supports international students pursuing pharmacy education in the US. These loans cover tuition, lab fees, and other academic necessities, easing the financial burden associated with pursuing a career in pharmacy.

Q6: How can I benefit from an international student loan for teaching school in the US?

A6: An international student loan for teaching school is designed for aspiring educators studying in the US. These loans help ease financial strain by covering tuition and living expenses, allowing students to focus on their training and preparation for a rewarding career in education.

Q7: Can I get an international student loan for art school in the US?

A7: Yes, you can. An international student loan for art school is tailored for international students pursuing creative education in the US. These loans cover tuition, art supplies, studio fees, and more, ensuring that aspiring artists can unleash their creative potential without financial worries.