A double top is a very bearish technical reversal pattern that happens when an asset's price goes up twice in a row and then down slightly. It is proven when the asset's price falls below a support level equal to the low between the two previous highs.

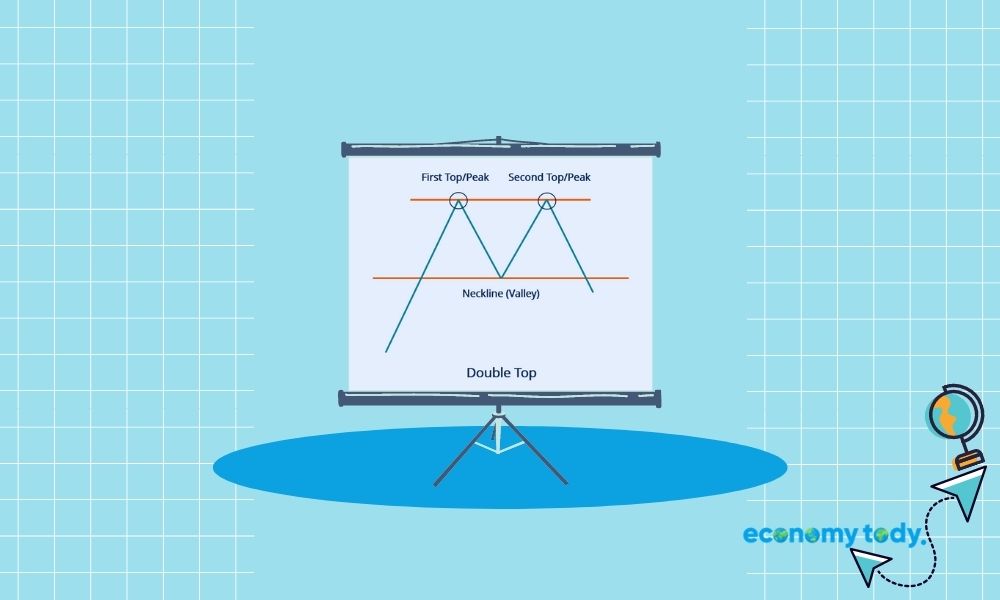

A double top usually happens at the end of a bull market. The price seems to have reached two peaks in a row. On a graph of price versus time, the peaks are usually the same price. One of the lowest prices is separation, or parting, which is one of the peaks.

The split or separation is also called a valley. The neckline of the price formation is the price level in the valley. When the price falls below the neckline, the price formation is considered to be confirmed and complete. It means that the price will go down even more or that another price cut is coming soon.

If a trader, trades, or analyst sees a double top, it means that buyers are in control of the market. So, there is more demand than supply until the first top forms. It raises prices. The trend then changes, and sellers start to control the market. Eventually, supply will be higher than demand. When there are more goods than people want, prices start to fall. It sets the price valley or the price neckline. After the valley, the bulls, or buyers, take back control of the market, and prices keep going up.

When traders realize that prices aren't going up above where they were at the first peak, sellers, or "bears," may take over and cause prices to go down. It makes it possible to build a double top. When prices drop below the valley, it is often seen as a sign that prices will go down further.

Like all other chart patterns, the double-top pattern should not be used on its own. Even though the formation may give an overview of what is going on between the bulls and the bears, analysts and traders need to be careful when identifying the formation and ensure it is accurate before making a trade.

When found correctly, double top formations are very useful. But if they are taken the wrong way, they can cause a lot of harm. Before coming to any conclusions, one must be very careful and patient.

Once the correct identification has been made, double-top formations are extremely useful. However, if they are understood in the wrong way, they have the potential to cause a great deal of harm. So, before drawing any conclusions, one must, as a result, exercise a great deal of caution and patience.