KEY POINTS

The rapid plunge pushed the stock below the $29 mark, where it first traded in September of this year and represented yet another significant turning point in the company's troubled recent months.

The linked fitness company's shares fell after CNBC reported that it was temporarily pausing production of its devices and were remained for volatility multiple times.

After the market closed, Peloton issued a press release that said its fiscal second-quarter revenue would be within its previously forecasted range. However, it said that the quarter ended December 31 would add fewer connected fitness subscribers than it projected. Peloton shares turned positive in extended trading on this announcement.

"As we discussed last quarter, we are taking significant corrective actions to improve our profitability outlook and optimize our costs across the company," said Chief Executive John Foley in a statement.

Peloton went public more than two years ago with an initial market capitalization of $8.1 billion. The stock briefly traded below the $29 threshold following its public debut, around mid-March of 2020, near the onset of the pandemic. Peloton shares were hovering around $23, as the broader market was tumbling amid the uncertainty of the coronavirus.

But as investors began to view Peloton as the ultimate stay-at-home stock, shares went on a massive rally. The stock hit an all-time intraday high of $171.09 on January 14 of last year, as Peloton reported triple-digit revenue growth and saw record-low levels of churn among users. At that point, it fetched a market cap of almost $50 billion.

However, investor concerns started to trickle in as Peloton's massive growth was coupled with supply chain constraints. Customers that had shelled out thousands of dollars for a Bike or one of Peloton's treadmill machines were reporting delivery delays, and Peloton was forced to invest to beef up its manufacturing capacity.

At first, Peloton resisted calls to recall its treadmill machines. Then, news of a child dying from an accident associated with Peloton's pricier Tread+ treadmill machine last March spooked both investors and consumers. As additional injuries were reported, Peloton issued a voluntary recall of its Tread and Tread+ products last May. Shares were trading below $100 at this point.

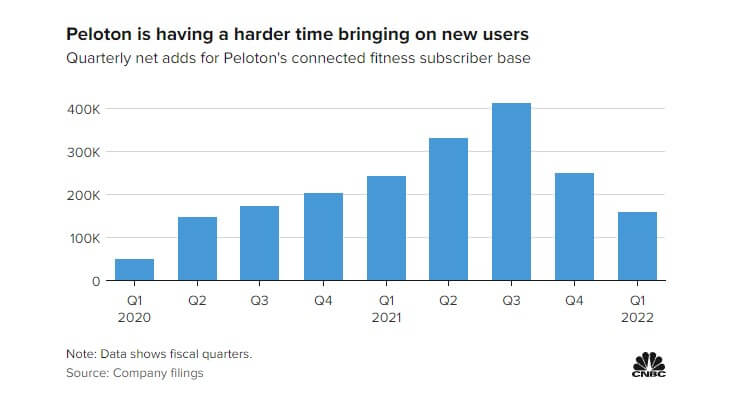

In recent months, Peloton has seen the pace of its revenue growth slow, and it isn't adding as many new users per quarter as it was a year earlier. Some of this could be expected, as the pandemic spurred extraordinary consumer demand for Peloton's fitness products when gyms were temporarily shut, and people wanted to work out at home. Now, though, consumers have a litany of at-home fitness options to choose from: Tonal, Hydrow, Mirror, Tempo, and Clmbr, to name a few. They can also opt to go back to a gym or a boutique fitness class.

After reporting three consecutive quarters of net income, Peloton booked a loss in the three months ended March 31, and its losses have mounted in the quarters since.

Peloton has said it doesn't expect to be profitable – before interest, taxes, depreciation, and amortization – until fiscal 2023.

CNBC reported on Tuesday that Peloton is now working with consulting firm McKinsey & Co. to look for opportunities to cut costs, which could include layoffs and store closures.

At the end of this month, it will also start to tack on shipping and setup fees for its Bike and Tread products, in part because of historical inflation. The price of its Bike will go to $1,745 from $1,495. Its less expensive treadmill will rise to $2,845 from $2,495. The Bike+ will remain $2,495, according to Peloton's website.

The Peloton had just slashed the price of its Bike last August by about 20% to $1,495, saying it hoped to give consumers a more affordable option.

JMP Securities analyst Andrew Boone said in a note to clients that the looming price hikes could bring in as much as an additional $150 million in revenue and gross profit in fiscal 2023. It could also encourage future customers to purchase Peloton's more expensive Bike+, he said, which isn't being impacted by the price hikes and could now be viewed as a more reasonable option.

But the extra fees could also hurt demand and push consumers to shop elsewhere.

Peloton is banking on product innovation and international expansion to help future fuel growth. It will soon start selling a strength product called Peloton Guide in a bundle with its heart-rate armband for $495. The hope is that existing users will become repeat customers when they purchase accessories, such as Peloton's dumbbells or cycling shoes and apparel.

After raising more than 440% in 2020, Peloton shares dropped 76% in 2021. Source