Stocks are on track to post weekly losses in what has been a disappointing month so far.

U.S. markets were neutral on Friday morning, following a late Thursday afternoon sell-off that wiped out gains on Wall Street.

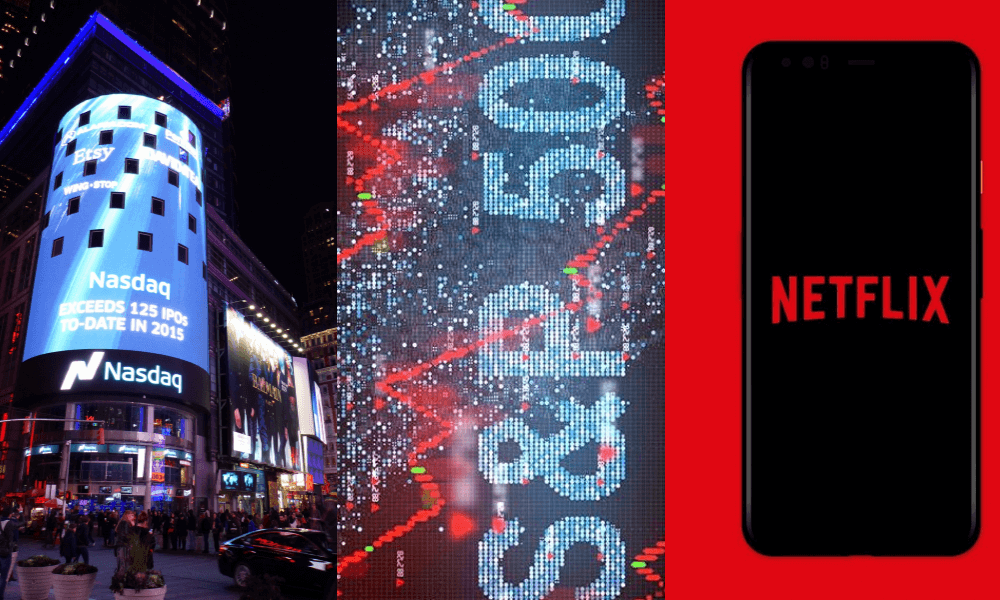

The Dow futures have fluctuated between gains and losses, while the Nasdaq, which is heavily weighted in technology, is forecasting a 0.5 percent drop.

The dramatic reversal was again driven by technology companies, which had been the source of tumultuous trading all week.

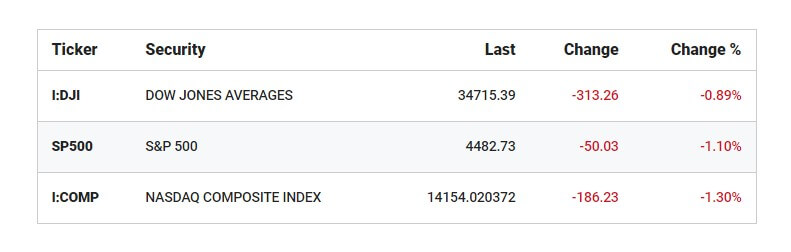

The S&P 500 lost 1.1% to 4,482.73, a three-month low, with nearly 85% of stocks in the index falling. It's now down 6% for the year.

The Nasdaq composite index fell 1.3% to 14,154.02, after rising as much as 2.1%. By Wednesday, the index's recent losses had left it in what Wall Street considers a market correction or 10% below its peak.

More than 500 Nasdaq stocks hit 52-week lows Thursday, including Starbucks and T-Mobile. Apple fell 1%, and chipmaker Nvidia shed 3.7%.

The Dow Jones Industrial Average sank 0.9% to 34,715.39.

The yield on the 10-year Treasury fell to 1.78% from 1.83% late Thursday.

The first week of the fourth-quarter earnings season ends on a quiet note, with oil services giant Schlumberger, consumer finance firm Ally Financial, regional bank Huntington Bancshares reporting.

The Conference Board will report its Leading Economic Index for December on the economic calendar. Watch for a 0.8% increase from the prior month.

In Europe, London's FTSE fell 1%, Germany's DAX lost 1.4%, and France's CAC declined 1.5%

Japan's Nikkei fell 0.9% in Asia after Toyota Motor Corp. announced production cuts due to parts shortages. The automaker said it would suspend production at 11 plants in Japan for three days, on top of reductions planned in February. Those cuts mean it will fall short of the 9 million vehicles designed for the fiscal year through March, despite healthy demand.

The Hang Seng in Hong Kong added 0.1%, and China's Shanghai Composite index shed 0.9%.

The Labor Department provided a disappointing update, reporting that the number of Americans applying for unemployment benefits rose to its highest level in three months as the fast-spreading omicron variant continued to disrupt the job market.

The latest corporate earnings round also gives investors a clearer picture of where Americans are spending money and how inflation is impacting the economy.

American Airlines fell 3.2%, and United Airlines slipped 3.4% after warning investors that the latest surge in COVID-19 cases would hurt their finances early in 2022. Both airlines reported losses for the fourth quarter, though they were smaller than analysts expected.

Netflix shares traded 20% lower in the premarket after adding 8.3 million new subscribers during the fourth quarter of 2021, falling just shy of the 8.5 million the streaming giant had expected.

Peloton shares got pummeled Thursday on reports it is pausing bike production, leading the company to issue an evening statement denying the claims. Shares fell 23.9% to $24.22, a two-year low. Shares were rebounding by more than 7% in the premarket. Thursday evening, Peloton co-founder and CEO John Foley issued a press release stating, "rumors that we are halting all production of bike and Treads are false."

In another trading, U.S. crude oil lost $1.83 to $83.71 per barrel in electronic trading on the New York Mercantile Exchange. It shed 25 cents to $85.80 on Thursday.

The basis for pricing international oil, Brent crude oil lost $1.73 to $86.69 per barrel. Source