On Friday, U.S. markets fell, capping a negative week and extending a rocky start to 2022. The Nasdaq Composite took the brunt of the losses, with the tech-heavy index having its worst week since 2020.

On Friday, the Nasdaq Composite fell 2.7 percent to 13,768.92. To 34,265.37, the Dow Jones Industrial Average dropped 450.02 points.

The Nasdaq fell 7.6% for the week, its lowest level since October 2020, and is now trading more than 14% below its November high.

Both the Dow and the S&P 500 finished the week with losses for the third week in a row and its worst weeks since 2020. The S&P 500 is down more than 8% from its all-time high.

The latest setback for technology investors is Netflix's dismal quarterly report. The streaming giant's stock dropped 21.8 percent on Friday following the release of its fourth-quarter results report, which revealed a slowing in subscriber growth.

Shares of its competitors fell as well, with Dow component Disney, which controls the Disney+ streaming service, down 6.9%.

Netflix is the first major internet company to disclose results this year, with Apple and Tesla following closely behind. Tesla's stock dropped 5.3 percent on Friday. Amazon and Meta Platforms, for example, both lost 6% and 4.2 percent, respectively.

The Nasdaq Composite has been pushed further into correction territory by significant losses in growth firms. Increasing rates put pressure on technology stocks by making their lofty valuations look less appealing.

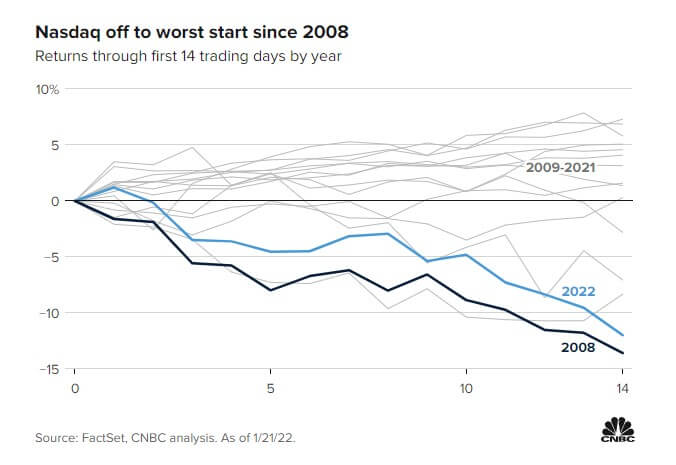

Through 14 trading days, the Nasdaq has had its worst start to a year since 2008.

"Given the emotional decline in the stock market of the last few days, fundamentals have been suspended as market action is entirely tied to technical support levels," said Jim Paulsen, chief investment strategist at Leuthold Group.

"Until a level is reached in this collapse... fundamentals like bond yields, economic reports, and even earnings releases will not likely have much impact.

Fear now must be extinguished by some stock market stability before traders and investors again start to consider fundamental drivers," added Paulsen.

The Nasdaq Composite's struggle is mainly due to a surge in government bond rates this week.

The U.S. 10-year Treasury hit as high as 1.9% on Wednesday as investors focused on the Federal Reserve's timeline for raising interest rates and broadly tightening monetary policy. However, bond yields retreated on Friday.

Investors will now be turning their attention to the Federal Reserve's January two-day policy meeting, set to start on Tuesday.

"While a handful of rate hikes over the next year or two would represent a shift in Fed policy, we wouldn't consider policy restrictive, and we don't expect the initial rate increase to derail the economic recovery," said Scott Wren, senior global market strategist at Wells Fargo Investment Institute.

However, he added that rate hikes would inject volatility into the market. Friday's selling intensified into the close, continuing a troubling pattern to start the year.

The S&P 500, on average, has fallen 0.16 percentage points in the final hour of trading in January, according to Bespoke Investment Group analysis through Wednesday.

That average last-hour performance places January in the bottom 1% of all months and third-worst since 2000, Bespoke found.

Small caps have also been hit hard this week.

The Russell 2000 secured its worst week since June 2020. The index fell 1.8% on Friday.

Bitcoin was also hit hard on Friday as investors brace for the Fed and dump riskier assets with higher rates ahead. On Friday, the digital asset fell more than 10% to around $38,233. Source